US $2600

| Condition: |

New: A brand-new, unused, unopened, undamaged item in its original packaging (where packaging is

applicable). Packaging should be the same as what is found in a retail store, unless the item is handmade or was packaged by the manufacturer in non-retail packaging, such as an unprinted box or plastic bag. See the seller's listing for full details.

...

|

Brand | INTUIT TURBO TAX |

Directions

Similar products from Other Retail Equipment & Accessories

Harley Davidson FXR Custom Side Covers / Panels 1982-1994 & 99-2000 Cafe Racer

NEW GILBARCO 700's FUEL DISPENSERS

96 Self-Stick Clear Hang Tabs Tags Slatwall Hook Retail Package Hangers

Sharp XE-A407 Cash Register - XEA407

6Oz Corn and Oil Kit 36 Per Case GOLD MEDAL PRODUCTS CO. 864.WP.2A

Used Red 4" Slatwall Straight Out - Box of 20

LOT 3 Harvey Prince Perfume Samples Sincerely, Ageless, Petaly Noir

Honeywell 7800-EHB Ethernet Home Base Battery Charging Dock

HIPAA Privacy & Security Awareness DVD Training Kit

Lot of 45 NEW 4x4x4 Red with White Polka Dot 2 PC Gift Boxes

HTC PERMANENT NETWORK UNLOCK CODE FOR HTC Vodafone VPx HTC 3 Hutchison P3600

Commercial Grade Mens Restroom Urinal $79

Harvey Prince Perfume HELLO 8.8 ml Deluxe Mini Travel Sz Roller-NEW IN BOX+GIFT

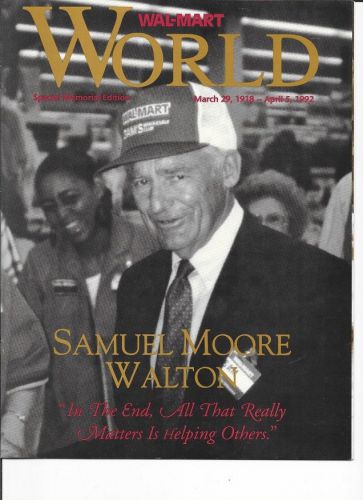

Wal Mart World Memorial Edition For Sam Walton 1992

BRAND NEW BSA M20 BLACK PAINTED CHROME PETROL TANK "CIVIL MODEL"

BRAND-NEW-NORTON-DOMINATOR-MODEL-7-FRONT-REAR-MUDGUARD-WITH-STAY-KIT-1950s

NEW NORTON DOMINATOR MODEL 7 FRONT & REAR MUDGUARD COMPLETE STAY KIT 1950'S

BRAND NEW NORTON DOMINATOR MODEL 7 FRONT & REAR MUDGUARD RAW STEEL 1950'S

BRAND NEW NORTON DOMINATOR MODEL 7 FRONT MUDGUARD RAW STEEL 1950'S

BRAND NEW VINCENT BLACK PAINTED PETROL TANK

People who viewed this item also vieved

T-Mobile LED Channel Letter Sign Retail Store Sign

MUFFLER - CATALYTIC CONVERTER X-Large Swooper Flag - N-1853

Lobster Sign Advertising Vinyl Banner /grommets -white 30" x 72" (6ft) made USA

Shopping Carts Blue Metal LOT 16 Grocery Liquor Used Store Fixtures Supermarket

Vintage METAL SHOPPING CART Fold Up GROCERY BUGGY Beer Caddy LAUNDRY Hamper

2 Tier SHOPPING CARTS Small Blue Metal Used Store Fixtures MINI Grocery Nursery

By clicking "Accept All Cookies", you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Accept All Cookies