US $24

Directions

Similar products from Jewel Disc Cases

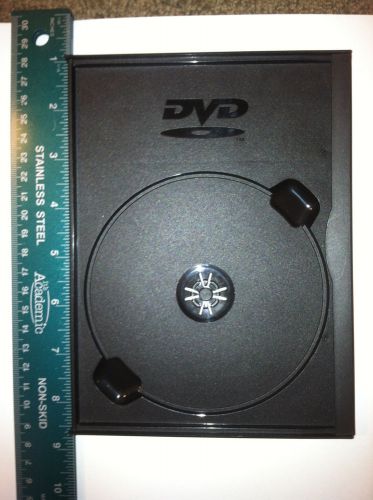

Lot of 5 NEW Replacement DVD Case Snapper Warner Bros New Line Image Snap 1 Disc

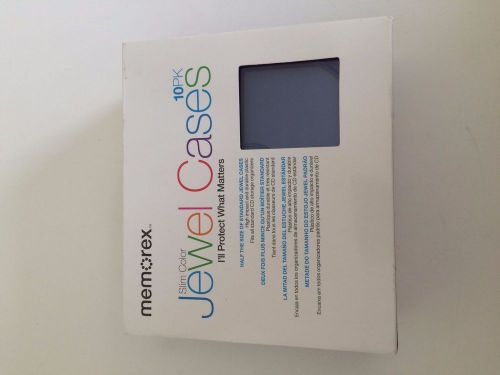

MEMOREX STANDARD CLEAR JEWEL CASES 10 Pack NEW

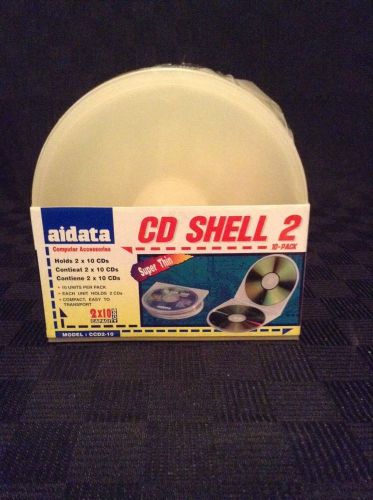

NIP Aidata CD DVD Shell 2 10 Pack Cases CCD2-10 Disks Clear Music Accessories

Lot of 105 Empty CD Cases Great for storing CDs and DVDs

Value Disc Black Slim Design CD Storage Cases. 100 Pack (New & Sealed) 9.8 Lbs

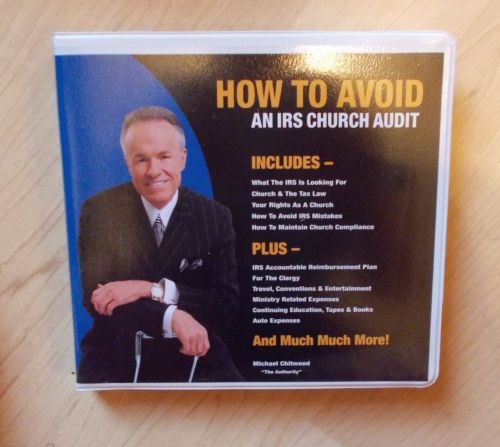

Church / Ministry Tax Law , Micheal Chitwood, 2 set CD "The Furor of U.B.I.T

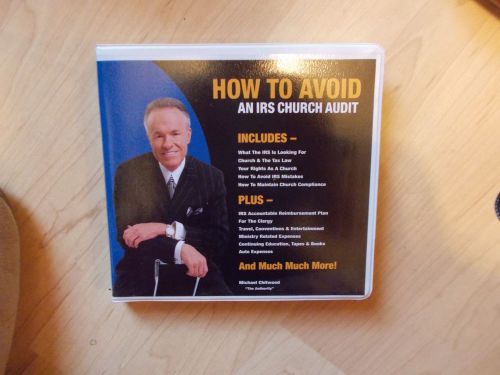

Church / Ministry Tax Law , Micheal Chitwood, 2 CD How to Avoid an Irs Audit

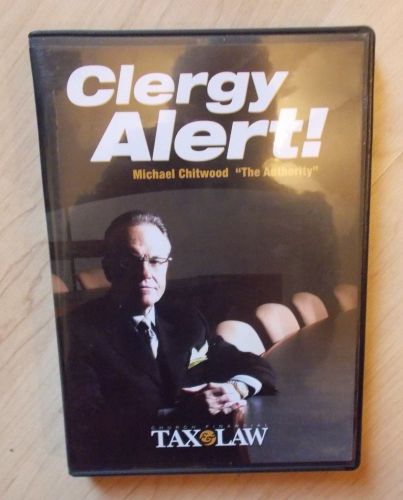

Church / Ministry Tax Law , Micheal Chitwood, 4 CD, Clergy Alert. Cover Assets

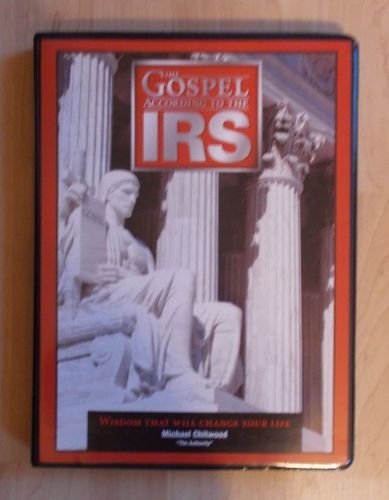

Church / Ministry Tax Law , Micheal Chitwood, 6 CD, The Gospel According to IRS

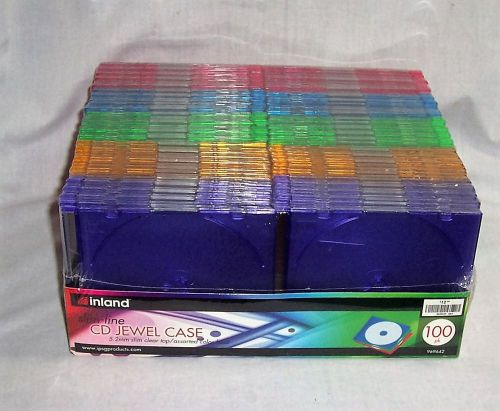

100 NEW inland Single Slim Multi Color CD DVD Jewel Case Box FREE SHIPPING

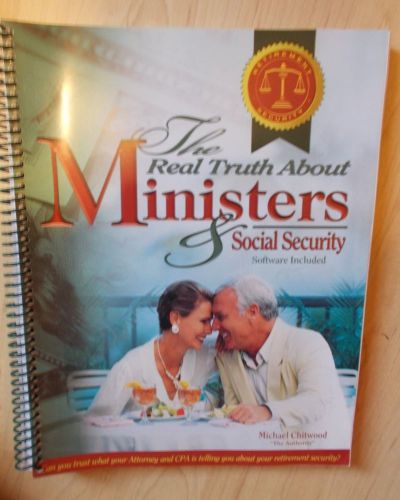

Church / Ministry, M. Chitwood Book, Real Truth About Ministers Social Security

Maxell Replacement Jewel Case CD-350 10 Pack

Belkin - 50 Pack - Slim Style Jewel Cases - NEW

Belkin Slim Style Jewel DVD CD-RW 50 Pack Disc Storage Photo Protection Back-Up

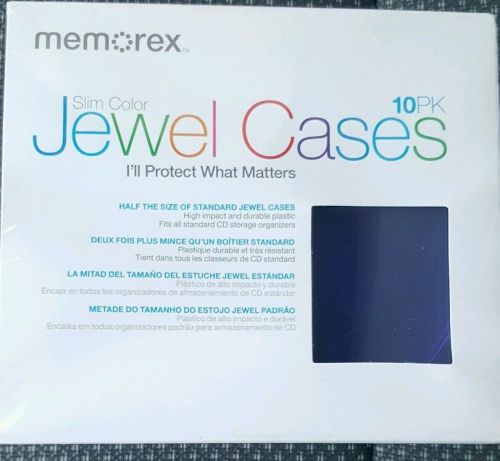

Memorex Slim Color Jewel Cases Pack of 10 NIB (BIN47)

2 - DOUBLE Jewel Cases for CD or DVD - NEW

50 Pack Slim 5.2mm Single CD DVD Jewel Cases

38 HP slim Jewel CD cases, multi colors

Lot 16 Clear Transparent Color Slim 5.2mm Single CD DVD Jewel Holder Cases

People who viewed this item also vieved

50 DVD Cases Single Disc Black New Replacement Storage

14mm Standard Black 1 Disc DVD Case Machine Grade - 50 Pack

74 BLACK SINGLE DVD CD CASES 14MM

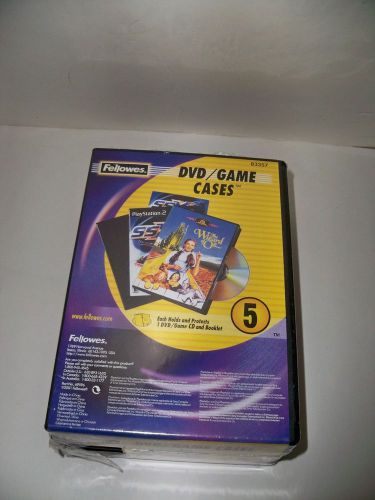

Fellowes DVD/Game Cases Package 5 Brand New

10 pcs Mini CD/DVD-R RW 3 inches (8 cm) Plastic Sleeve

3 Hubs + Lit (8 1/2" x 11") Full Size CD / DVD Album with Literature Case

6 Hubs + Lit (8 1/2" x 11") Full Size CD / DVD Album with Literature Case

50 PCS 20-DISC 2 RING CD/DVD ALBUM W/SLEEVE, BLACK MH10

NEW Fellowes CD Sleeves 100 CD Capacity Clear Vinyl Double Sided-50-Pack

NEW Quality Park CD/DVD Envelopes, Assorted Colors, Pack of 50 (68905)

BestDuplicator White Cd/dvd Paper Sleeves Envelopes with Flap and Clear Window -

50 CD DVD Paper Sleeve Clear Window CDR Envelopes Flap

By clicking "Accept All Cookies", you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Accept All Cookies