US $6100

Directions

Similar products from Other Plastic Processing Tools

500mm Lead Screw 8mm Thread 2mm Pitch Lead Screw with Copper Nut

Conair Vacuum Loader Matching Stainless Steel Hopper RDN Novatec AEC Whitlock

T8 200mm Lead Screw 8mm Thread Lead Screw 2mm Pitch Lead Screw with Brass Nut

Used- Wysong 72" Wide In-Line Shear. Hydraulic operated. Includes controls. Moun

Used- Fixed position winder, approximate (2) 74" x 6" diameter rolls driven by 2

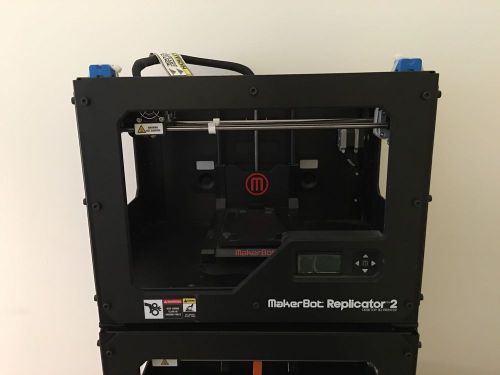

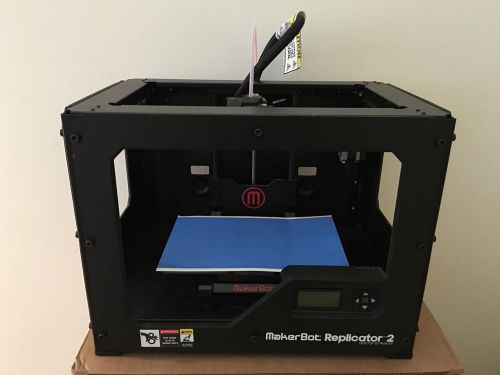

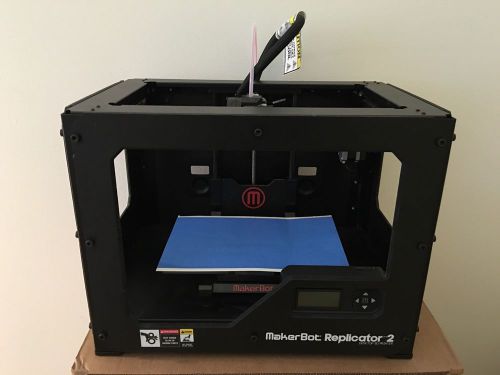

Makerbot Replicator 2 NEW with ZERO HOURS, complete with acc. 3D Printer NEW

Makerbot Replicator 2 NEW with ZERO HOURS, complete with acc. 3D Printer NO BOX

Makerbot Replicator 2 w/ 25 HOURS, complete with acc. 3D Printer Excellent!

Makerbot Replicator 2 w/ 32 HOURS, complete with acc. 3D Printer Excellent!

SIBE AUTOMATION DRYING OVEN VACUUM FORMING ABS LEXAN THERMOFORMING 48"X48"X60"

Z-ULTRAT Blue 3D Printing Filament – 800g Spool

Z-ABS Red 3D Printing Filament – 800g Spool

SIBE AUTOMATION PLC CONTROL SYSTEM FOR CYCLE & HEATERS VACUUM FORMING MACHINE

INFRARED HEATERS 12" x 12" VACUUM FORMER THERMOFORMING

# 8 HIGH TEMPERATURE MGT ELECTRIC WIRE HEATERS PER FOOT

SIBE AUTOMATION VACUUM FORMING MACHINE 60"X60" THERMOFORMING DUALENDER DUAL HEAT

#12 HIGH TEMPERATURE MGT ELECTRIC WIRE HEATERS PER FOOT 1000°F 600V OVENS

SIBE AUTOMATION DRYING OVEN THERMOFORMING VACUUM FORMING 144"X72"X120" NEW

SIBE AUTOMATION DRYING OVEN POLYCARBONATE ABS ACRYLIC VACUUM FORMING 48"X48"X72"

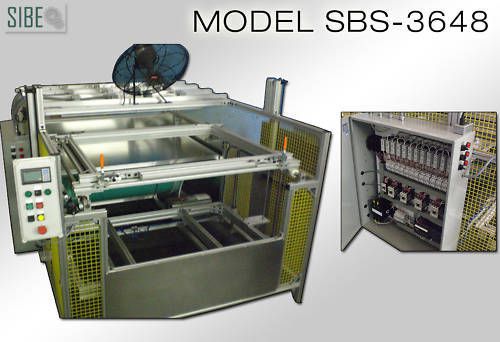

SIBE AUTOMATION VACUUM FORMING MACHINE 36"X48 " THERMOFORMING AUTOMATIC

People who viewed this item also vieved

CALORITECH HEATER 460V 2400W 1X1 TMC404330

HEATRON MAX 2000 0035 B2A5J39-A1 115V 730W

PLASTIC PROCESS EQUIPMENT INC. CTC-148

Drawer Magnet 4" Inlet / Outlet #34326

By clicking "Accept All Cookies", you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Accept All Cookies